A Personal Loan Can Secure Your Future Too

- Dialabank

- Mar 30, 2021

- 3 min read

A few years back not all people from rural areas had access to contact banks for financial assistance but now it has changed. Now all people can get help for their respected queries in one on one interaction with the managers.

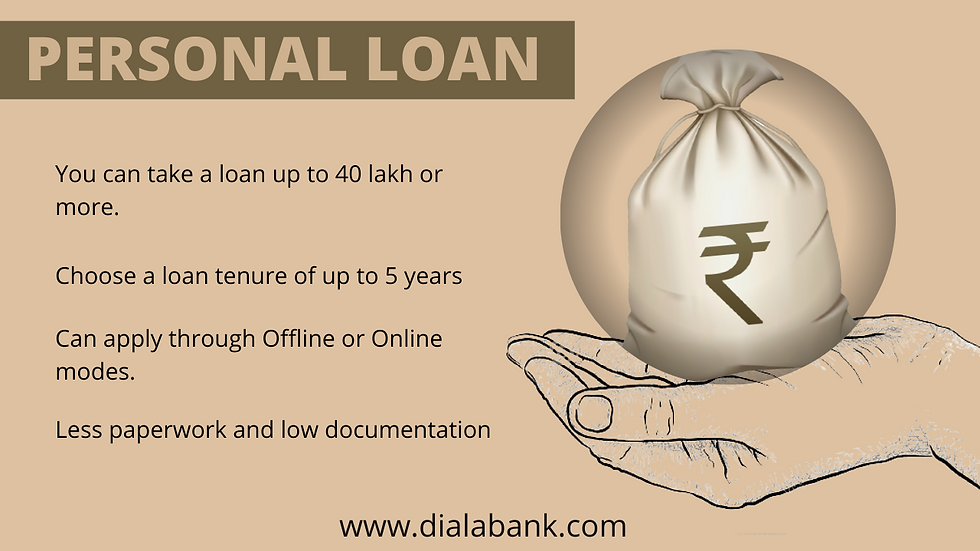

As every decision has a good and bad taking loans or in the particular personal loan has its benefits or features, mistakes or its cons. One can apply Personal Loan apply online.

Below are some of the reasons why a personal loan can become a part of the future: Consolidating Credit Card Debt: Generally, credit card payments are more flexible and can be paid off in small amounts at a flexible period. But when it comes to personal loans, they usually have a certain period inside which the amount taken as a loan with the interest has to be paid and if any delay it can increase the burden as these payments are supposed to be paid in a bigger amount of money as compared to the credit card payments.

Being Flexible and Versatile: There are plenty of loan opportunities in the market these days, some of them are car loans, medical loans, educational loans etc. But these loans are not flexible, i.e you can't use these loans unless it’s for the specified or already stated purpose. Whereas on the other hand, a personal loan is more flexible and versatile it can be used for many purposes stated above, i.e marriage, education, purchasing assets, purchasing property, to paying off other debts. Getting guidance from an expert in the field can be a great advantage.

Lesser Interest Rate Higher Borrowing Limit: As compared to the interest rates of the recent bank’s loan options, a personal loan has the least interest rate under a specified comparison. In the specification of the Allahabad Bank Personal Loan, the interest rate for the personal loan is between12.15%. The lower the interest rate the more it becomes unburden some. Customers with an excellent credit history can avail of a good amount of crest from the bank.

No Financial Promise Required: All loans most likely end up asking valued property as a guarantee for the money they give but when it comes to a personal loan, such a requirement is not needed and thus no collateral is required while using a personal loan. Financial promises can be a building, deed of ownership, car, gold etc.

Some of the mistakes or the drawbacks of getting a personal loan even normal or general loans can be as follows, an i.e increase in debt, higher payments than the credit card itself, fees and the penalty can be high and turns into more burdensome.

Simple Eligibility: The eligibility to avail of personal loans is quite simple, the following are the main key attitudes that are considered. The applicant must be residing of India. Different banks have different eligibility criteria. Some give loans to international citizens or NRI. The other one is the age the person should be at least 25-58 and these vary according to companies. And such individuals should have a certain amount of salary for the bank to have a guarantee of payment. The basic salary requirement is Rs 30000 and above.

Piling Of Debts: One of the mistakes which happen to an individual who is not properly guided is that when a person starts getting money at ease they tend to use that opportunity more often and then in the end this may result in piling up burdens from loans. And in the end, rather than getting money to pay the debt more and more new loans are taken and in the end instead of freeing themselves from loans they end up flooding in more.

Conclusion: Taking a personal loan should be done after evaluating all possible risk, and one can use this to secure one’s future. Whether it's for education or leisure purposes.

Comments